- Invest in 24K gold backed by 99.9% pure gold bullion.

- Store your gold in bank-grade lockers.

- Option to convert digital gold into coins or bars.

- Easy integration with your existing PhonePe wallet.

- Quick and secure transactions.

- Invest in digital gold and other assets from a single app.

- Minimal delivery and making charges apply for physical gold.

- Store gold in 100% insured, secure vaults.

- Convert your gold into bars or coins.

- Store your digital gold for up to 5 years.

- Easy buying and selling with just a few clicks.

- Option to withdraw assets after 24 hours.

- Backed by MMTC-PAMP gold of international standards.

- Limited to gold investment—no other asset classes available.

- Paytm is ideal for those who prefer a straightforward, no-fuss approach to investing in gold.

- Buy 24K 99.99% purity MMTC-PAMP international-grade gold.

- No storage fees—store your gold in secure lockers indefinitely.

- Gift digital gold to friends with ease.

- No storage charges.

- Easy, user-friendly interface.

- Secure transactions backed by Google’s trusted platform.

- A minimum purchase of 1 gram is required.

- Live tracking of international gold prices.

- Zero account opening fees.

- No storage charges.

- Simple, intuitive interface.

- Easily switch between different asset classes.

- No hidden fees.

- Limited to gold investments—no jewellery conversion options.

- 24K 99.9% pure gold backed by Augmont Gold.

- No storage fees for up to five years.

- Redeem gold in coins or bars.

- Easy integration with Airtel services.

- Start investing with just ₹1.

- No hidden charges.

- Limited to gold investments.

1. Introduction

Digital gold investment has become a popular alternative to traditional gold buying in India. With the convenience of online platforms, investors can now purchase, store, and sell gold digitally without needing physical possession. This article will explore the top five digital gold investment apps in India in 2024, providing a comprehensive guide to help you choose the right platform for your needs.

2. What is Digital Gold?

Digital gold is an innovative financial product that allows investors to buy and sell gold electronically. Unlike physical gold, digital gold is stored in secure vaults by trusted institutions, and investors receive digital certificates representing their ownership.

Benefits of Digital Gold Investment

Investing in digital gold offers numerous advantages, including ease of purchase, low investment thresholds, and eliminating storage concerns. Additionally, digital gold can be easily converted into cash or physical gold, providing liquidity and flexibility.

3. How Digital Gold Investment Works

Process of Buying Digital Gold

To buy digital gold, investors need to choose a platform, such as a mobile app, and create an account. Once registered, they can purchase gold in small fractions, typically starting from as low as ₹1.

Storage and Security of Digital Gold

The purchased digital gold is stored in secure vaults managed by the app's partner institutions, such as MMTC-PAMP or SafeGold. These vaults are insured, ensuring the safety of your investment.

Selling Digital Gold

Selling digital gold is as straightforward as buying it. Investors can sell their gold holdings through the app and receive the equivalent amount in cash directly into their bank accounts.

4. Key Features to Look for in a Digital Gold App

Security and Reliability :

When choosing a digital gold app, security is paramount. Ensure the app is partnered with trusted institutions and offers robust encryption and authentication features.

User Interface and Experience :

A user-friendly interface and seamless experience are essential for managing your investments efficiently. Look for apps that offer intuitive navigation and clear information displays.

Charges :

Different apps may have varying charges, including purchase fees, storage fees, and selling commissions. It's crucial to compare these costs to maximize your returns.

Integration with Financial Services :

Some digital gold apps offer integration with other financial services, such as mutual funds, insurance, and UPI payments. This feature can provide added convenience and flexibility in managing your finances.

Listed below are the 15 best gold investment apps in India in 2024

1.PhonePe: Trusted, Reliable, and Easy to Use

PhonePe needs no introduction—it’s already one of India’s leading online payment platforms. But did you know that you can also invest in digital gold through PhonePe? Partnering with SafeGold and MMTC-PAMP, PhonePe offers a secure and straightforward way to buy and store gold.

Features:

Pros:

Cons:

If you’re already using PhonePe for your daily transactions, adding digital gold to your portfolio is just a few taps away.

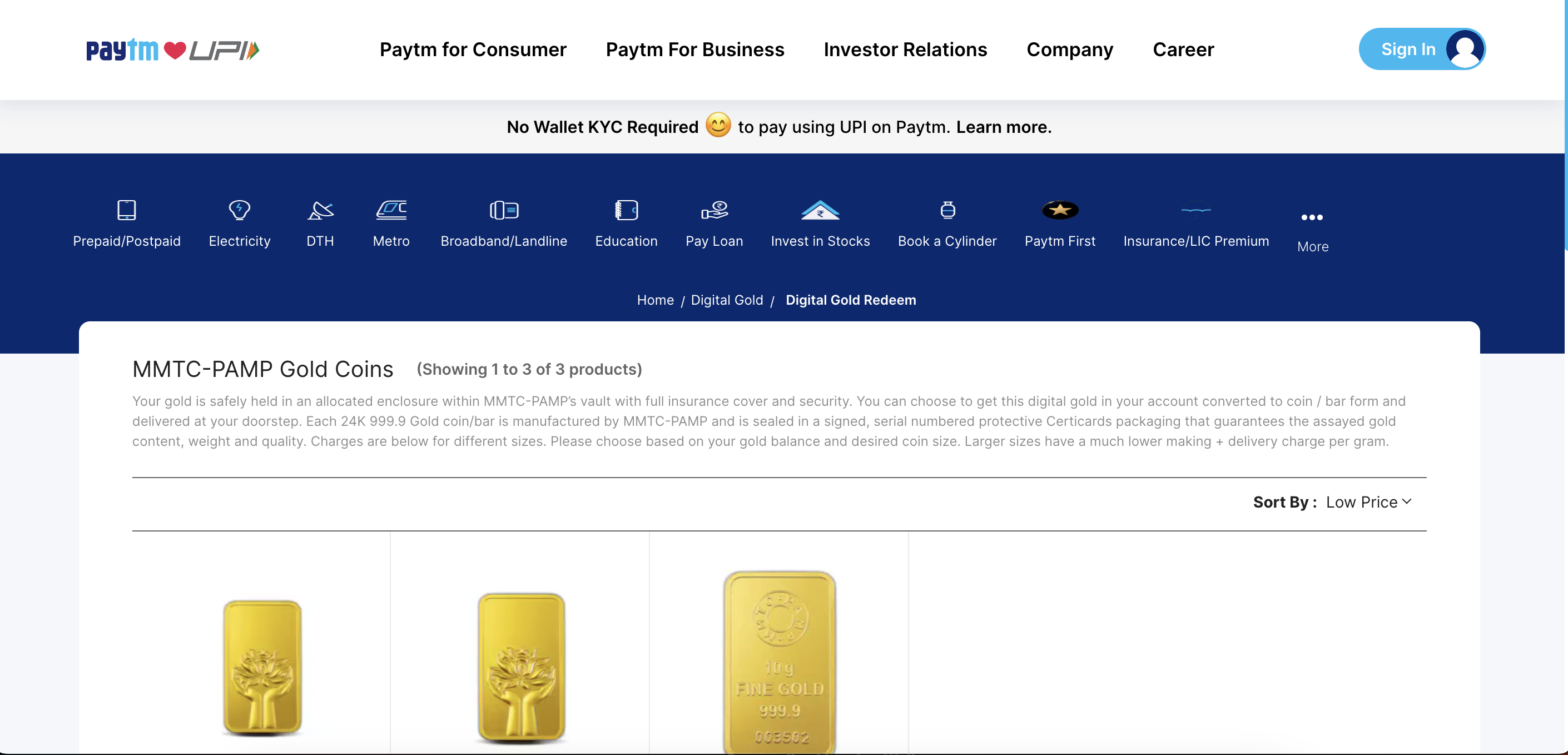

2.Paytm: Invest, Store, and Redeem—All in One Place

Paytm has become a household name in India, and its digital gold investment platform is just as popular. With Paytm, you can purchase 24K 999.9 gold at live prices, store it securely, and even convert it to physical gold or cash.

Features:

Pros:

Cons:

3.Google Pay: Invest in Gold with the Click of a Button

Google Pay isn’t just for paying your bills or transferring money. With its digital gold feature, you can now buy, store, and even gift gold to your friends and family. It’s gold investment made simple, with the added trust of Google.

Features:

Pros:

Cons:

If you’re looking for a hassle-free way to invest in digital gold, Google Pay is as reliable as it gets.

4.Groww: A One-Stop Solution for All Your Investment Needs

Groww isn’t just about stocks and mutual funds. The app now allows you to invest in digital gold, thanks to its partnership with Augmont Gold. You can track the value of your gold investment in real time and even redeem it whenever you want.

Features:

Pros:

Cons:

Groww is an excellent choice for investors who want to manage all their investments from a single platform.

5.Airtel Payment Bank: Gold Investment on the Go

Airtel Payment Bank’s digital gold platform makes it easy for you to start investing in gold with just ₹1. You can buy, sell, and store your gold securely, all while earning rewards on your Airtel transactions.

Features:

Pros:

Cons:

Contact us today to develop your custom digital gold trading app

Frequently Asked Questions (FAQs)

What is the minimum investment in digital gold?

Most apps allow investments starting from as low as ₹1, making digital gold accessible to everyone.

How is digital gold different from physical gold?

Digital gold is stored electronically, while physical gold requires storage and is prone to risks like theft.

Can I convert digital gold to physical gold?

Yes, most apps allow you to convert your digital gold into physical gold, which can be delivered to your address.

What are the tax implications of investing in digital gold?

Gains from digital gold are subject to capital gains tax, similar to physical gold. It's advisable to consult a tax expert for detailed advice.

1. Introduction

Digital gold investment has become a popular alternative to traditional gold buying in India. With the convenience of online platforms, investors can now purchase, store, and sell gold digitally without needing physical possession. This article will explore the top five digital gold investment apps in India in 2024, providing a comprehensive guide to help you choose the right platform for your needs.

2. What is Digital Gold?

Digital gold is an innovative financial product that allows investors to buy and sell gold electronically. Unlike physical gold, digital gold is stored in secure vaults by trusted institutions, and investors receive digital certificates representing their ownership.

Benefits of Digital Gold Investment

Investing in digital gold offers numerous advantages, including ease of purchase, low investment thresholds, and eliminating storage concerns. Additionally, digital gold can be easily converted into cash or physical gold, providing liquidity and flexibility.

3. How Digital Gold Investment Works

Process of Buying Digital Gold

To buy digital gold, investors need to choose a platform, such as a mobile app, and create an account. Once registered, they can purchase gold in small fractions, typically starting from as low as ₹1.

Storage and Security of Digital Gold

The purchased digital gold is stored in secure vaults managed by the app's partner institutions, such as MMTC-PAMP or SafeGold. These vaults are insured, ensuring the safety of your investment.

Selling Digital Gold

Selling digital gold is as straightforward as buying it. Investors can sell their gold holdings through the app and receive the equivalent amount in cash directly into their bank accounts.

4. Key Features to Look for in a Digital Gold App

Security and Reliability :

When choosing a digital gold app, security is paramount. Ensure the app is partnered with trusted institutions and offers robust encryption and authentication features.

User Interface and Experience :

A user-friendly interface and seamless experience are essential for managing your investments efficiently. Look for apps that offer intuitive navigation and clear information displays.

Charges :

Different apps may have varying charges, including purchase fees, storage fees, and selling commissions. It's crucial to compare these costs to maximize your returns.

Integration with Financial Services :

Some digital gold apps offer integration with other financial services, such as mutual funds, insurance, and UPI payments. This feature can provide added convenience and flexibility in managing your finances.

Listed below are the 15 best gold investment apps in India in 2024

1.PhonePe: Trusted, Reliable, and Easy to Use

PhonePe needs no introduction—it’s already one of India’s leading online payment platforms. But did you know that you can also invest in digital gold through PhonePe? Partnering with SafeGold and MMTC-PAMP, PhonePe offers a secure and straightforward way to buy and store gold.

Features:

Pros:

Cons:

If you’re already using PhonePe for your daily transactions, adding digital gold to your portfolio is just a few taps away.

2.Paytm: Invest, Store, and Redeem—All in One Place

Paytm has become a household name in India, and its digital gold investment platform is just as popular. With Paytm, you can purchase 24K 999.9 gold at live prices, store it securely, and even convert it to physical gold or cash.

Features:

Pros:

Cons:

3.Google Pay: Invest in Gold with the Click of a Button

Google Pay isn’t just for paying your bills or transferring money. With its digital gold feature, you can now buy, store, and even gift gold to your friends and family. It’s gold investment made simple, with the added trust of Google.

Features:

Pros:

Cons:

If you’re looking for a hassle-free way to invest in digital gold, Google Pay is as reliable as it gets.

4.Groww: A One-Stop Solution for All Your Investment Needs

Groww isn’t just about stocks and mutual funds. The app now allows you to invest in digital gold, thanks to its partnership with Augmont Gold. You can track the value of your gold investment in real time and even redeem it whenever you want.

Features:

Pros:

Cons:

Groww is an excellent choice for investors who want to manage all their investments from a single platform.

5.Airtel Payment Bank: Gold Investment on the Go

Airtel Payment Bank’s digital gold platform makes it easy for you to start investing in gold with just ₹1. You can buy, sell, and store your gold securely, all while earning rewards on your Airtel transactions.

Features:

Pros:

Cons:

Contact us today to develop your custom digital gold trading app

Frequently Asked Questions (FAQs)

What is the minimum investment in digital gold?

Most apps allow investments starting from as low as ₹1, making digital gold accessible to everyone.

How is digital gold different from physical gold?

Digital gold is stored electronically, while physical gold requires storage and is prone to risks like theft.

Can I convert digital gold to physical gold?

Yes, most apps allow you to convert your digital gold into physical gold, which can be delivered to your address.

What are the tax implications of investing in digital gold?

Gains from digital gold are subject to capital gains tax, similar to physical gold. It's advisable to consult a tax expert for detailed advice.